Automotive industry in Colombia: top 3 foreign companies that invest in the country

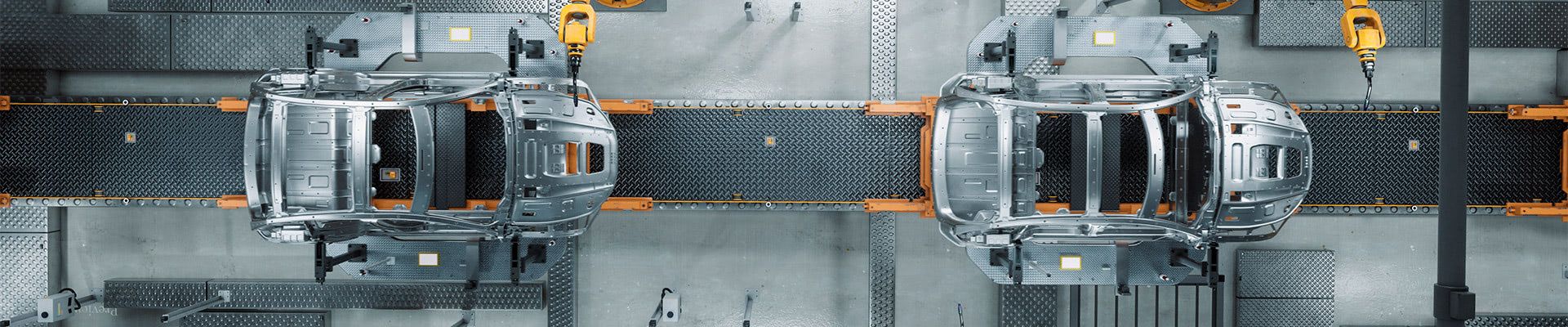

The Colombian automotive industry has experienced reactivation on several fronts despite the difficulties brought by the post-pandemic scenario (lack of inventory, logistical delays, among others). The sector has shown signs like the positive figures for auto parts exports, the significant increase of vehicles in circulation, and, above all, the investment of large companies that choose the country thanks to factors such as its incentives for foreign direct investment (FDI), it's business climate or its competitive infrastructure.

State of the automotive industry and Colombian auto parts exports

According to data from Fitch Connect, Colombia ranked fifth in vehicle sales in the continent, registering 6.7 million units, a figure that goes hand in hand with the 33% growth in vehicle sales and the increase of vehicles in circulation, all by the end of 2021. This last figure went from 16,042,336 in 2020 to 17,020,451 in 2021, maintaining an annual average of +5.7%, according to ANDI, FENALCO, and RUNT data. One of the main factors that have driven reactivation is FDI. Incentives such as the logistical advantages offered by Colombia due to its geographical location -mostly costs and times- and investment incentives, among which are the exemption of customs duties for the import of inputs not produced in the country or the duty-free import of CKD material for the production of vehicles and auto parts, among others, have boosted FDI. On the other hand, and regarding exports, Colombian auto parts figures have grown significantly, averaging more than US$330 million annually and going from US$320.4 million in 2020 to US$356.8 million in 2021, as reported by DANE.

Top 3 brands investing in the country

- General Motors: The automotive giant, which arrived in the country 66 years ago, continues to invest in the Colombian automotive industry. With more than 1,500,000 vehicles assembled since its arrival, the company has focused on renewing its light vehicle production plant in Colombia (with an investment of US$50 million), seeking, among others, to assemble 35,000 units per year of the Chevrolet JOY (Chevrolet being the second best-selling brand in the country) and to double truck production to more than 12,000 units, which is a production record in this segment. In addition, one of its brands, Chevrolet, shows significant growth, with a market share of 17.1%, growing 3.3% over the previous year.

- Renault-SOFASA: The French company, which arrived in Colombia in 1969 and has been in the country for 53 years, was a pioneer in the region and is a leader in the local and international market, as it has been leading the market for four years and, in the first half of 2022, maintained its leadership, with Renault being the best-selling brand in the country. After investing US$5 million in 2019 and US$80 million in 2021 in the modernization of its central plant, located in Envigado, Antioquia, its bet is to increase production, guaranteeing the permanence of its industrial activity and ratifying its vote of confidence in the country.

- Hino-Toyota: The Japanese brand, part of the Toyota group, has been in the country for 30 years, since it arrived in 1992 as an exclusive importer, building the first plant in the country to assemble buses five years later. In 2007 they built their new plant, supplying the regional market and turning Colombia into a regional production center. With its recent commitment to the DUTRO series, belonging to light and ultra-light vehicle segments, in 2021, Hino had a market share of 8% and 12.8% in these segments, respectively, both of which are growing (up 40% and 14% in 2021, respectively) due to companies renewing and increasing vehicle fleet.

The future is encouraging for the Colombian automotive sector, as confirmed by the EOSA (Automotive Sector Opinion Survey), according to which 82% of vehicle brand owners stated that the state of their companies is good, and 44% are confident that the sector's sales will increase in the coming years.