In 2021, the sector sold 250,497 vehicles in the local market, and Colombia remained the fourth-largest vehicle manufacturer in Latin America.

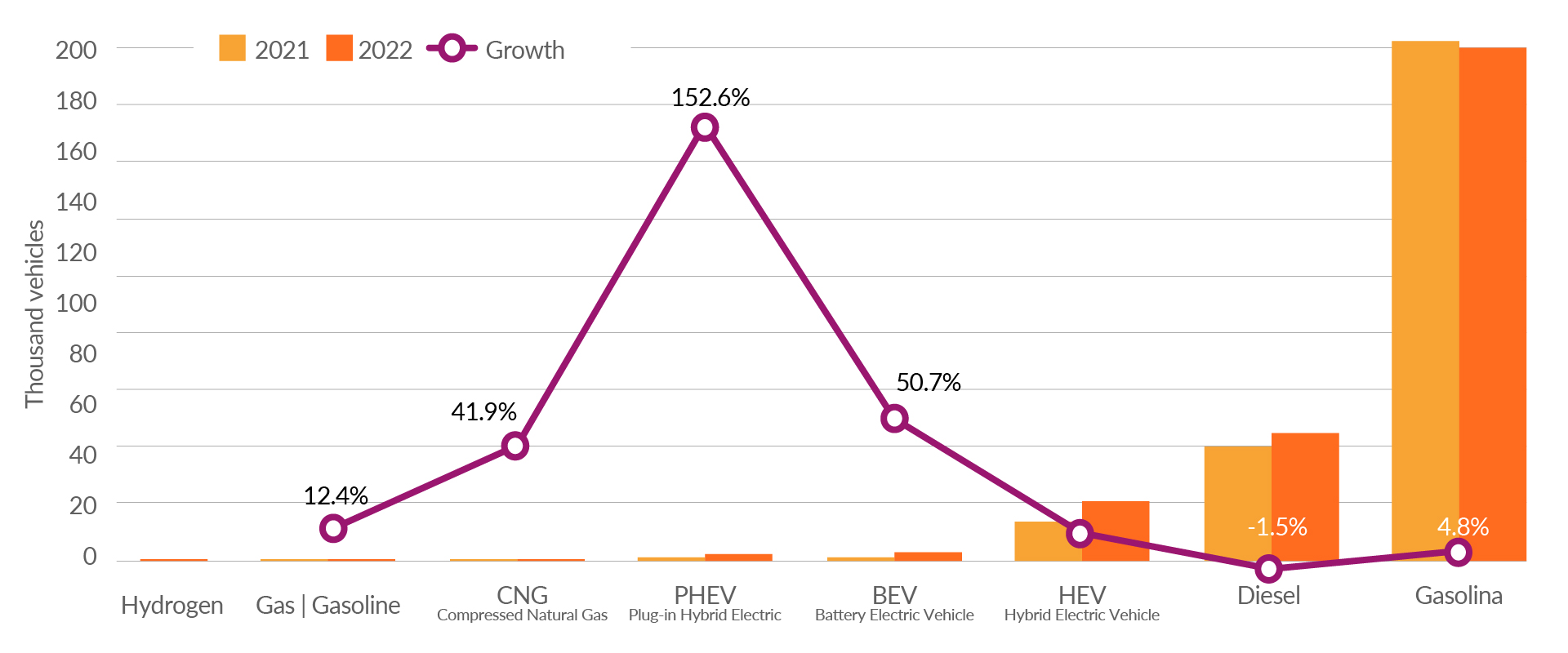

Passenger car sales by type of fuel, 2022

Imagen

Vehicles powered by gasoline are the best-selling in the country. However, hybrid and electric vehicles are the fastest growing in sales

General Motors plant, Bogotá, Colombia

ATTRACTIVE DOMESTIC MARKET WITH POTENTIAL FOR AUTOMOTIVE INDUSTRY DEVELOPMENT

- In 2021, the vehicle fleet in Colombia totaled 17 million vehicles in circulation, of which 6.7 million, or 39%, were cars.

- In Latin America, 5.5 million vehicles were manufactured in 2021, and Colombia remained the fourth-largest producer, with 44,140 units manufactured.

- In 2021, 250,497 vehicles were sold in Colombia, a 33% increase compared to 2020, and sales are expected to grow an average of 4% annually between 2022 and 2025.

- The most significant sales segment is the family and tourism car segment, with a 41% market share, followed by SUVs with a 39% market share. The SUV segment has experienced the most significant sales growth, as it represented only 28% of total sales in 2016.

- Colombia's low motorization rate represents potential demand for vehicle assembly companies to cover. The country has 87 vehicles per 1,000 inhabitants, well below countries like Argentina, which has 227 vehicles per 1,000 inhabitants despite having a smaller population.

- Some departments with potential for assembly and auto parts activities are Bogotá, Cundinamarca, Antioquia, the Coffee Region, and Valle del Cauca.

COLOMBIA HAS A STRATEGIC LOCATION FOR OPERATIONS WITH REGIONAL AND GLOBAL REACH

- With a strategic position in Latin America, Colombia has become an important hub for passenger and cargo transportation in the continent.

- Companies in Colombia can serve the Latin American market, which imported over USD 42 billion in vehicles in 2021.

- Colombia exported a total of 14,312 vehicles in 2021, mainly family and tourism vehicles (USD 143 million) and cargo vehicles (USD 97 million). These exports mainly go to countries with trade agreements in Central and South America.

- The country has a network of trade agreements that allow companies to enter markets in the automotive sector in Europe and North and South America with 0% tariffs.

COMPETITIVE INFRASTRUCTURE OF THE AUTOMOTIVE INDUSTRY IN COLOMBIA

- The country has an extensive network of support companies that facilitate the operations of assembly companies, with about 600 companies engaged in the manufacturing of automotive parts and accessories, close to 2,000 companies registered in the automotive trade activity, and more than 4,600 companies registered in the maintenance and repair activity of vehicles.

- The automotive parts industry is represented by manufacturers with high potential to supply the automotive industry, certified with the IATF 16946 standard.

- The country has entrepreneurial initiatives around the automotive sector, such as the Chamber of the Automotive Industry of the National Association of Industrialists (ANDI), the National Association of Sustainable Mobility (ANDEMOS), the Colombian Association of Automotive Parts Manufacturers (ACOLFA), and the Automotive Sector and its Parts Association (ASOPARTES).

- Between 2015 and 2020, Colombia recorded more than 452,000 graduates in engineering programs, ideal for supplying the sector's need for skilled labor.

THE AUTOMOTIVE INDUSTRY HAS INCENTIVES THAT SEEK TO BOOST THE DEVELOPMENT AND COMPETITIVENESS OF THE SECTOR

- A program aimed at vehicle assemblers and automotive parts manufacturers called PROFIA allows for the importation of inputs that are not produced in Colombia, with exemption from tariff duties. The benefit applies regardless of whether the final product is intended for the local market or for export.

- The assembly regime for the automotive industry permits the duty-free importation of CKD material for the production of vehicles and auto parts, to be assembled in private depots for transformation and assembly or in free trade zones. Vehicles can be sold to Andean Community countries with 0% customs duty, provided that certain minimum levels of subregional content are met.

- There is also an option to import goods classified as raw materials and capital goods with 0% tariff that do not have domestic production.

SOME IDENTIFIED NICHE MARKETS

- SUVs: The segment with the highest sales growth in recent years.

- Commercial vehicles: The Government seeks to renew more than 25,000 trucks in the cargo fleet due to the end of their useful life.

- Buses: High demand for replacement in integrated public transport systems in major cities in the country.

INVESTMENT OPPORTUNITIES IN THE VEHICLE INDUSTRY IN COLOMBIA

- Construction of assembly plants for utility vehicles, commercial vehicles (including buses) and cargo vehicles to meet local demand and export to the region.

- Construction of manufacturing plants for vehicle parts.

- Transfer of technology from international companies to local companies with experience in the production of parts and components for vehicles

We are part of your team

Imagen

PROCOLOMBIA is the entity in charge of promoting Exports, International Tourism, Foreign Direct Investment and the Country Brand, in order to position Colombia in the world. Get to know the national and international network of offices, where you will find comprehensive support and advice.